If you want a loan for blacklisted people, It is very difficult to obtain but that doesn’t mean is impossible. I have collected a list of where to get a loan as a blacklisted individual living in South Africa best part there is no credit check.

Most registered and reputable financial institutions will conduct a credit check to assess your creditworthiness and ability to repay the loan. Blacklisting indicates a history of poor debt management, making lenders hesitant to provide credit without evaluating the risk.

However, there might be a few ways to bypass that legally and get a loan very easily. In this article, I will give you all the options for where to get loans for blacklisted people.

Can You Get a Loan If You Are Blacklisted?

Yes, you can! While it’s harder, there are still lenders in South Africa who offer loans for blacklisted people. These lenders understand that life happens and sometimes, people just need a second chance.

Some lenders offer:

- No credit check loans

- Secured loans (you offer something valuable as security)

- Short-term payday loans

- Loans for people under debt review (in rare cases)

When you are blacklisted, it affects your credit score, and most banks will not give you a loan.

Places That Offer Loan for Blacklisted People in South Africa

Here are some platforms and companies known to offer loans to blacklisted people:

- Lend Plus

- Xcelsior Loans

- Coughlans

- Cash Crusaders

These companies offer quick, simple loan options for people with poor credit or no credit history. Keep reading to learn how each one works, what you need to apply, and how fast you can get your money.

1. Lend Plus

Lend Plus is a loan company that helps people who are blacklisted or under debt review. They are registered with the National Credit Regulator (NCR), which means they are safe and follow the rules.

Type of Loan Ledplus Offers:

- Personal Loans

- Blacklisted and under debt review

The process to apply is simple. You visit Ledplus website, fill out a short online form, and upload your documents. These include your South African ID, proof of income like a payslip or bank statement, and proof of where you live. With Lend Plus, you can borrow between R1,000 and R150,000, depending on how much you earn and what you qualify for.

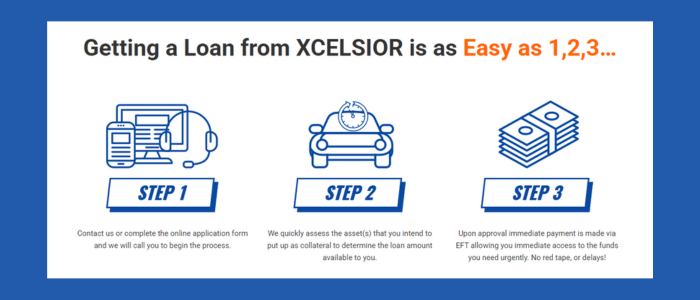

2. Xcelsior Loans

Xcelsior Loans gives loans based on your vehicle, not your credit score. Even if you are blacklisted, you can still qualify if you own a car, bakkie, or motorbike that’s fully paid off.

They allow you to borrow money using your vehicle as collateral, and the best part is you can still drive your car while repaying the loan.

Type of Loan Xcelsior Offers:

- Secured loans using a vehicle as collateral

- Loans for blacklisted people

- Loans without credit checks

You can apply online or visit an Xcelsior branch. To apply, you need all your documents like ID, Bank Statement. After completing the application, your vehicle will be inspected, and if approved, the loan can be paid out on the same day.

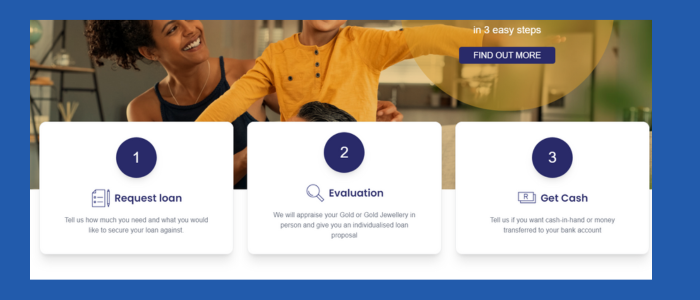

3. Coughlans Loan

Coughlans is a long-standing financial service provider that offers personal loans to people who are blacklisted, under administration, or going through debt review.

They help clients who have been rejected by banks or other lenders. Coughlans looks at your income and affordability instead of your credit score.

Type of Loan Coughlans Offers:

- Personal loans

- Loans for blacklisted individuals

- Loans for people under administration or debt review

The application process is done online. You go to Coughlans website and complete the loan application. After applying, a consultant will contact you. Once approved, the funds are deposited within 1 to 2 working days. Loan amounts start from R500 and can go up to R15,000 or more, depending on your situation.

4. Cash Crusaders (Pawn Loans)

Cash Crusaders is known for buying and selling second-hand goods, but they also offer instant pawn loans for people who need quick cash and may be blacklisted.

With pawn loans, you take a valuable item — like a smartphone, laptop, or camera — to a Cash Crusaders branch. They evaluate it and offer you a loan based on its value. You leave the item with them and get cash immediately.

Type of Loan Cash Crusaders Offers:

- Instant pawn loans

- Loans for blacklisted people

- No payslip or bank statement needed

There is no need to fill out long forms. Simply:

- Visit a Cash Crusaders branch

- Bring your ID and proof of address

- Bring an item of value (electronics, tools, musical instruments, etc.)

They will inspect the item and offer a loan on the spot. You walk out with the money, and when you repay the loan, you get your item back. This is a great option if you don’t have payslips or if you’re unemployed but own valuable items.

Tips Before Taking a Loan When Blacklisted

- Always borrow only what you can afford to repay.

- Check that the company is NCR-registered.

- Read the terms and ask questions before signing any agreement.

- Avoid loan scams that ask for upfront payments.

If the loan you need is less than R500 you can consider trying ways to make money online in South Africa

Frequently Asked Questions (FAQs)

If you are blacklisted, you can still get a loan from lenders who do not rely on credit checks. Companies like Lend Plus, Xcelsior Loans, and Coughlans offer loans to people with poor credit history. Some options include using your car or valuable items as security or proving your ability to repay the loan through income.

Yes, you can. Being blacklisted affects your ability to get credit, not to open a basic bank account. Most banks in South Africa allow you to open a transactional account even if you are blacklisted.

Capitec Bank uses Experian, TransUnion, and sometimes Compuscan to check your credit history. If you are blacklisted with these bureaus, it may affect your loan approval with Capitec.

No, Capitec usually does not offer loans to people who are blacklisted or under debt review. They check your credit record as part of their loan approval process.

PEP does not offer personal loans directly. They often promote loans in partnership with financial service providers like Capfin. Capfin requires a good credit score, so PEP loans may not be ideal for blacklisted individuals.

No, EasyPay does not offer direct loans but partners with loan providers. Some clients receive loan offers via EasyPay after being pre-approved. However, it’s not guaranteed for blacklisted people.

Disclaimer

I am not a financial advisor. This article is based on my own research and findings. Always do your own research or speak to a qualified financial advisor before making any decisions.

While the companies listed above offer services to blacklisted individuals, you should still contact them directly to confirm their latest terms, conditions, and loan options.